Insuring the Gig Economy: Protecting Workers in the On-Demand World

Read this in-depth article to learn more about the changing face of insurance in today's gig economy. Learn how insurance companies are adapting their policies for independent contractors including rideshare drivers, food delivery drivers, and freelancers. Learn how to protect your financial stability in the on-demand economy by understanding the significance of transferable benefits and navigating the complexity of gig insurance. Insurance for the "gig economy," including "portable benefits," "insurance solutions," and "financial security," all have hashtags.

Introduction

People's working lives have been completely transformed by the gig economy, which offers a greater degree of flexibility along with a heightened sense of autonomy. Because of the increase in the number of people working in gig economies, such as rideshare drivers, food delivery couriers, and freelancers, there is now a new difficulty to face: ensuring that those who work in this on-demand world have enough protection. This article examines the consequences of the gig economy for insurance policies and explains how insurers, led by the E.A.T principles developed by Google, are stepping up to protect the financial stability and mental well-being of gig workers.

1. Understanding the Gig Economy Landscape

To facilitate an understanding of the significance of insurance for the gig economy, we will first provide an outline of this rapidly expanding industry. We shed light on the specific dangers that employees in the gig economy, also known as independent contractors or freelancers, confront by investigating the many roles that can be played within the industry. Readers gain an understanding of the significance of tailor-made insurance solutions when they acknowledge the precarious and variable nature of gig labor.

2. Rideshare Insurance: Filling the Coverage Gap

The possibility of insurance coverage lapses occurring while the driver is still actively employed is something that most drivers who provide ridesharing services worry about. This section examines the challenges that are posed by normal auto insurance plans and the manner in which rideshare insurance fills the void that is left by these policies. This article focuses on the efforts that insurers are trying to offer individualized coverage that protects both the driver and the passengers in circumstances involving ridesharing.

3. Protecting Food Delivery Couriers: The Last Mile Challenge

Insurance is an essential component of the safety net that food delivery couriers need because they are exposed to a variety of dangers while on the road. Within the scope of this subheading, we investigate the many insurance policies that cater to the special requirements of delivery drivers, such as coverage for accidents, injuries, and the liabilities associated with food orders. We also go through how insurance companies are modifying their policies to accommodate the particular requirements posed by the gig economy.

4. Freelancer Insurance Solutions: Beyond Liability Coverage

Freelancers are a diverse group of professions, ranging from consultants and photographers to freelance writers and designers. Freelancers also include individuals who work in photography. Photographers can also work as independent contractors. This section goes beyond merely offering liability insurance for freelancers and tackles the more extensive insurance needs that they have. In order to protect freelancers against the danger of accruing financial and legal liabilities, we look at the significance of professional liability insurance, covering for errors and omissions, and cyber liability insurance.

5. Portable Benefits and Gig Workers' Welfare

The idea of portable benefits is becoming increasingly popular in light of the fact that gig workers frequently do not have access to the conventional benefits sponsored by their employers. This topic investigates the growing interest in portable benefits and investigates whether or not it is feasible to offer gig workers advantages that may be carried over to multiple platforms and gigs. In addition to this, we talk about the possible roles that collaborations between the business sector and the government could play in this attempt.

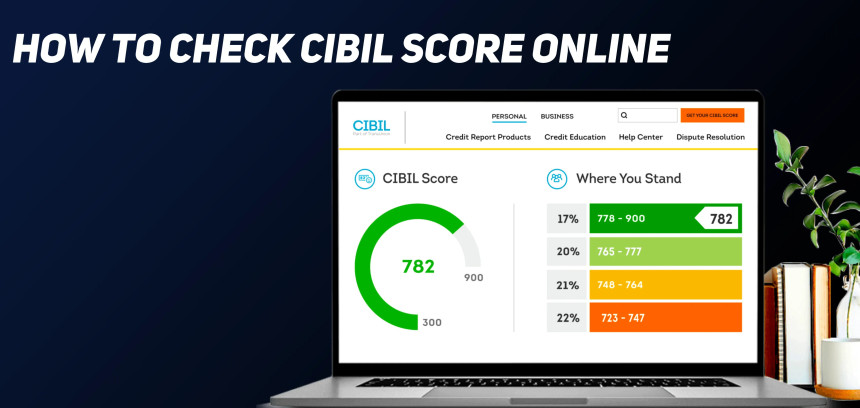

6. Navigating the Complexities of Gig Insurance

The requirements for insurance that gig workers may be subject to are likely to be complicated, and it can be difficult to locate the suitable coverage for one's needs. This section provides guidance on how to evaluate various insurance options, compare policies, and make sense of the fine print of a policy from industry specialists who have extensive experience in the field. By guiding our readers through the maze of gig insurance and giving them the tools they need to make decisions that are well-informed and will help them preserve their livelihoods, we are able to give them the opportunity to make well-informed judgments.

Conclusion

As the "gig economy" continues to see explosive growth, it is more important than ever to meet the healthcare requirements of its labor force. Insurers are beginning to recognize the dynamic nature of gig labor and are proposing customized solutions to protect workers in the on-demand world. These insurers are adhering to the E.A.T standards developed by Google. Workers in the gig economy can experience more financial security if they take use of specialist insurance products and portable benefits. This will enable them to concentrate on what they do best, which is contributing to the dynamic and always-changing gig economy.

Tags

#GigEconomyInsurance, #InsuranceForGigWorkers, #RideshareInsurance, #FoodDeliveryCourierCoverage, #FreelancerInsurance, #PortableBenefits, #GigEconomyProtection, #GigWorkerSafety, #InsuranceSolutions, #FinancialSecurity, #GigWorkerBenefits, #OnDemandWorkforce, #GigEconomyRisks, #InsuranceGuide, #GigWorkerWellbeing