A Comprehensive Guide on How to Check Your CIBIL Score in India

Learn how to check your CIBIL score in India with our comprehensive guide. Discover the step-by-step process online, offline, and through mobile apps. Understand the importance of monitoring your creditworthiness and take control of your financial health.

Introduction

Today's monetary climate puts a lot of emphasis on credit scores when it comes to assessing an individual's creditworthiness. In India, the most renowned credit rating agency is the Credit Information Bureau (India) Limited (CIBIL). Keeping track of your CIBIL score is crucial for managing your financial situation and having the ability to get credit when necessary. This article will provide you with instructions on how to check your CIBIL score in India.

Understanding CIBIL Score

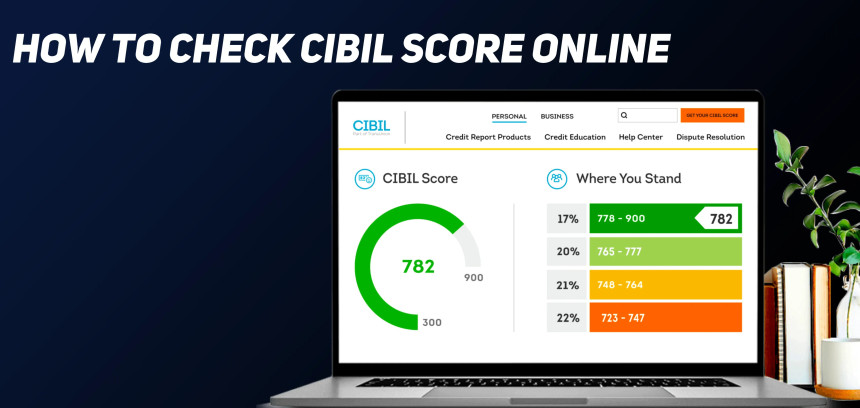

Before we start discussing the process, we should first comprehend what a CIBIL score is and why it is significant. This score is a three-digit numerical evaluation of your creditworthiness, which varies between 300 and 900. The higher the number, the more likely you are to get approved for credit products such as loans and credit cards.

Lenders use your CIBIL score as a risk indicator when considering lending you money. A good score shows that you are financially responsible, regularly repay your debts, and have a low likelihood of being unable to pay back the loan. On the other hand, a poor score may reflect non-payment of loans, late payments, or excessive reliance on credit, which can make it difficult to get credit in the future.

Exploring the various ways to check your CIBIL score in India is now possible. Here are the different methods that can be used:

1. Online Method:

- How to visit the CIBIL website: Start by visiting the official website of TransUnion CIBIL (www.cibil.com).

- How to create an account: Click on the "Get Your CIBIL Score" tab and select the appropriate option based on whether you are an individual or a company. Proceed to create an account by providing the necessary details.

- How to authenticate your identity: After creating an account, you will need to verify your identity. Provide the requested details, including your PAN card number, personal information, and contact details.

- How to pay the required fee: Once your identity is verified, you will be redirected to the payment gateway. Pay the fee to obtain your CIBIL score and credit report.

- How to access your CIBIL score: After successful payment, you can access your CIBIL score and credit report instantly. Review the report carefully to identify any discrepancies or errors.

2. Offline Method:

- How to download the CIBIL score request form: Visit the CIBIL website and download the CIBIL score request form in the prescribed format.

- How to fill in the required details: Fill in the requested information, including your personal details, contact information, and identification documents.

- How to attach necessary documents: Attach self-attested copies of your identification documents, such as PAN card, Aadhaar card, and address proof, along with the form.

- How to send the form via mail: Prepare an envelope and send the filled-in form along with the required documents to the address mentioned on the form.

- How to wait for processing: CIBIL will process your request and generate your credit score within a few business days. You will receive your CIBIL score and credit report by mail.

3. Through Mobile Apps:

CIBIL score-checking apps are available on various mobile platforms, such as Android and iOS. How to download a credible app from the respective app store, create an account, and follow the instructions provided to obtain your CIBIL score.

Main Points to Remember:

1. Knowing when to check your CIBIL score is essential in order to stay aware of your creditworthiness and to detect any mistakes which could possibly affect your credit profile.

2. Understanding the aspects which affect your score is important, like payment history, credit utilization, credit mix, and credit inquiries. This knowledge will assist you when it comes to making money-related decisions.

3. If you find any errors or discrepancies in your CIBIL score or credit report, you must get in touch with CIBIL as soon as possible to fix them. Errors could have a damaging effect on your creditworthiness and borrowing power.

Conclusion

Monitoring your CIBIL score in India is an uncomplicated task that can be performed on the internet, in person, or with apps designed for this purpose. This article explains the procedure for checking your CIBIL score and remaining aware of your creditworthiness. It is significant to keep track of your CIBIL score regularly in order to maintain a sound financial record and make sure you can access credit when necessary. Having a good credit score opens up more financial possibilities.