Understanding the Factors Behind Rising Insurance Rates in the United States: A Comprehensive Analysis

Find out the causes of the rising insurance costs in the US. This thorough investigation investigates the variables that affect insurance rates, from calamities to technological developments. Recognise the causes of rising insurance costs and develop coping mechanisms for this changing environment.

Introduction

Our lives depend heavily on insurance since it offers security and comfort against a variety of hazards and uncertainties. However, many people and companies all throughout the United States have noticed a large spike in their insurance costs in recent years. Many people have questions about why insurance premiums are rising and what causes may be behind this trend. We will examine the causes of rising insurance costs in the US in this post and offer a thorough analysis of the problem.

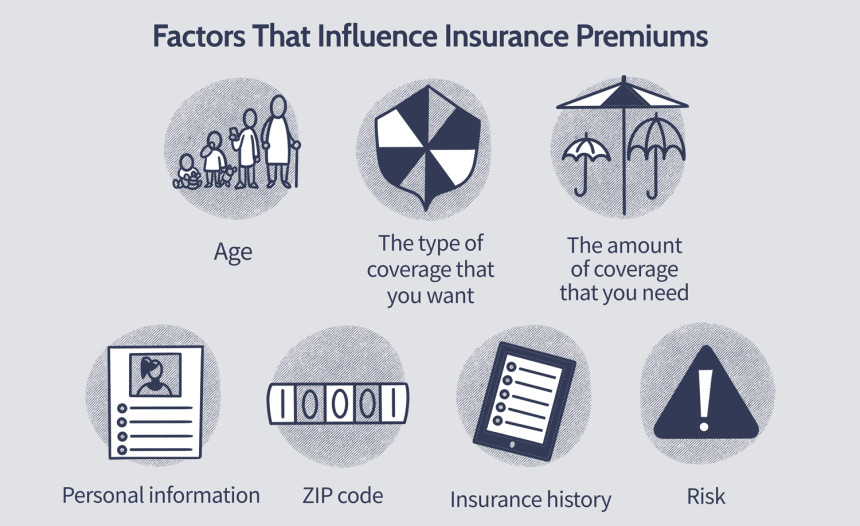

Insurance is a complex industry influenced by various factors, both internal and external. Let's examine some key reasons why insurance rates are increasing in the United States:

- Catastrophic Events: Natural disasters and catastrophic events have become more frequent and severe in recent years. Hurricanes, floods, wildfires, and other natural calamities result in substantial property damage and financial losses for insurance companies. To compensate for these losses, insurers increase premiums to maintain their financial stability and adequately cover policyholders' risks.

- Inflation: Inflation affects various aspects of the economy, including insurance. Rising costs of goods and services, such as medical expenses and automobile repairs, impact the amount insurance companies pay out in claims. As a result, insurers raise premiums to offset these increased costs and maintain profitability.

- Advances in Technology: While technology has brought significant advancements and convenience, it has also led to higher insurance rates. Modern vehicles often come equipped with sophisticated safety features and expensive electronic components. When accidents occur, the cost of repairing or replacing these advanced technologies escalates, resulting in higher claim payouts for insurers.

- Medical Costs: Health insurance premiums have witnessed a substantial increase in recent years. The rising cost of medical treatments, prescription drugs, and hospital services directly impacts health insurance premiums. Additionally, the increasing prevalence of chronic diseases and the aging population add further strain to the healthcare system, leading to higher insurance rates.

- Legal Factors: Legal factors, including litigation and lawsuits, significantly contribute to rising insurance rates. Personal injury claims, medical malpractice lawsuits, and excessive jury verdicts have become more common, resulting in higher costs for insurers. To cover these increased expenses, insurance companies raise premiums to maintain profitability and meet their obligations.

- Insurance Fraud: Fraudulent activities in the insurance industry have a detrimental impact on insurance rates. Fraudulent claims, staged accidents, and exaggerated damages lead to increased payouts for insurers. To counteract this, insurance companies increase premiums to compensate for fraudulent losses and protect themselves from financial losses.

- Market Conditions: The overall state of the insurance market also influences premium rates. During periods of economic instability or when insurers experience significant financial losses, they may raise premiums to mitigate risks and maintain their financial stability. Similarly, a reduction in competition within specific insurance sectors can result in higher rates for policyholders.

- Changing Demographics: Changes in population demographics can affect insurance rates. For example, an increase in the number of elderly drivers may lead to higher automobile insurance premiums due to higher accident risks associated with older age. Similarly, population shifts and increased urbanization can impact home insurance rates, as densely populated areas may be prone to higher risks, such as theft or property damage.

It is significant to keep in mind that these elements can change depending on the type of insurance, including house, auto, health, and business insurance. The market dynamics and specific risk variables associated with each type of insurance vary, which has resulted in an overall increase in insurance rates.

Both people and companies can investigate a number of measures to lessen the effects of rising insurance premiums. Effective techniques to potentially cut insurance prices include comparing quotations from various insurance providers, enhancing safety precautions, implementing preventive steps to reduce risks, and maintaining a solid credit score.

Conclusion

In conclusion, a variety of variables, such as catastrophic occurrences, inflation, technological advancements, rising medical costs, legal considerations, insurance fraud, market conditions, and shifting demographics, all contribute to increased insurance rates in the United States. For policyholders to make informed decisions and efficiently manage their insurance expenses, it is imperative that they are aware of these aspects. Individuals and organisations may manage the shifting insurance landscape while guaranteeing adequate protection against risks and uncertainties by remaining proactive and investigating diverse strategies.

Tags

#insurance, #why_insurance_rates_are_increasing, #insurance_US